Investors Beware! Microcap stocks are risky, ‘the odds are stacked against you.’

Stock fraud has devastating effects on victims and thus, reporting on stock fraud is extremely important.

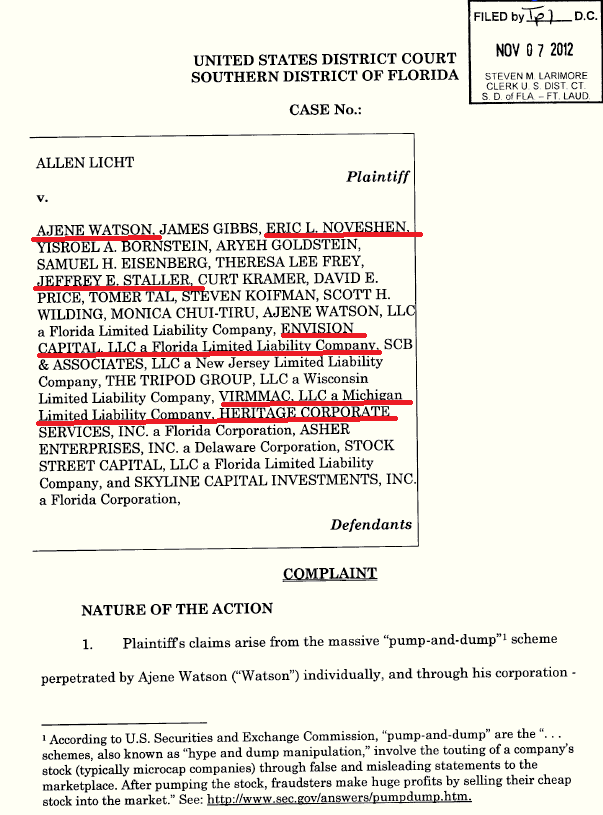

On January 29, 2010, the FBI published a story about a ten year investigation into pump-and-dump stocks scams. The investigation uncovered more than 40 schemes, convicted 40 perpetrators, identified thousands of victims in nearly every state and discovered hundreds of millions of dollars in losses.

That pump-and-dumps target elderly investors is no secret. That the FBI can’t keep up with the pace of pump-and-dump scams is no secret, they sprout like “mushrooms.” That perpetrators of stock fraud don’t want coverage of their actions is common sense. If information is easy to obtain in a simple google search, less people will fall victim.

https://www.fbi.gov/news/stories/2010/january/fraud_012910

From the FBI story:

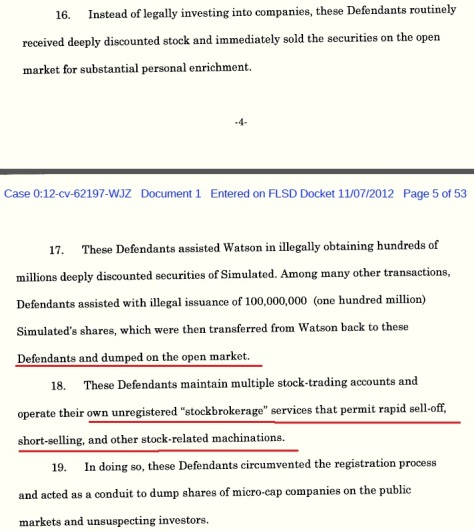

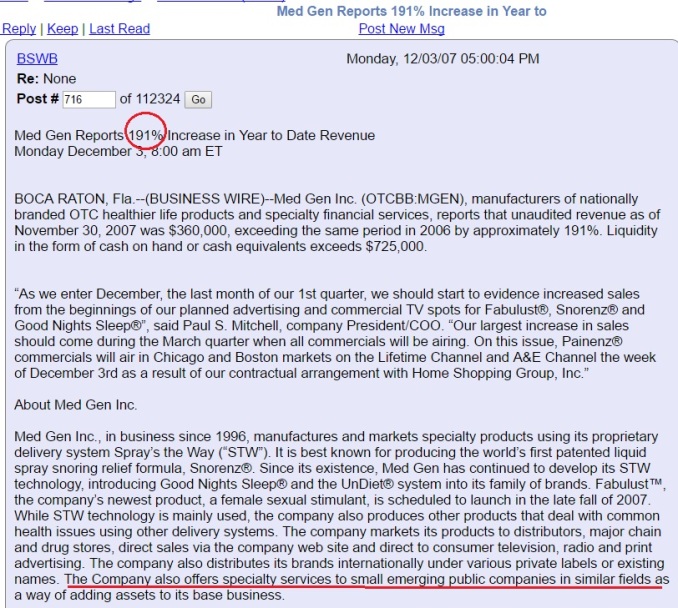

How do these scams work? In this case, the ringleaders created shell companies whose penny stock (worth less than $5 a share) was traded on the OTC Bulletin Board (not on the more widely known New York Stock Exchange or NASDAQ). They secretly issued most of the shares for themselves in fictitious names, then touted their companies’ stock through false statements in press releases, electronic bulletin board postings, online newsletters, and the like.

Often using their retirement funds, unsuspecting investors purchased the highly-touted stock—or their unscrupulous financial advisors did so without their knowledge—driving or “pumping” up the price. Then, the fraudsters “dumped,” or sold, their stock for thousands or millions of dollars, causing the stock to plummet and innocent investors to lose their shirts.”

In many cases, the losses were significant. And while running an undercover operation and gathering enough evidence to put the criminals behind bars, our focus has been on helping victims get some of their hard-earned money back. We spent years interviewing more than 600 mainly elderly victims, painstakingly documenting their sometimes heartbreaking losses. For example:

- We assisted a doctor from a prestigious hospital who began suffering from severe depression after learning of the scam and became unable to work. To help a husband and wife who had both developed dementia during the investigation, our agents traveled to their nursing home and spent hours with them, their family members, and their accountants to substantiate their financial losses.

- We worked with a man suffering from multiple sclerosis whose stockbroker had liquidated his pension and IRA and left him nearly penniless.

- We learned of another victim who not only invested her savings and her pension, but also took out a second mortgage to invest more. Needless to say, she lost everything.

An investment blog on Reddit offered a behind the scenes look at the inner workings of one particular IR (investor relations) company – that was a pump-and-dump shop. “Stock Jockey” states, “The “odds are stacked against you right from the beginning. In your efforts to do some research on a penny stock, you may find yourself reading some forums and thinking you are getting unbiased opinions. You are not!

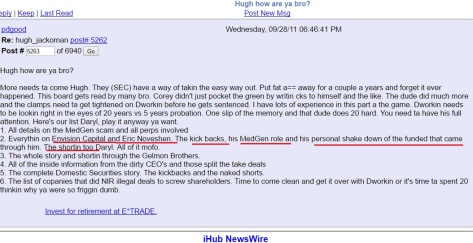

IR companies often handle investor relations for a large number of small cap stocks. People usually don’t get to see what really goes on. In the back office of one particular IR company there was a large space dedicated to about ten desks that had a computer and 2 screens on each desk. There were ten young guys all tapping away on their keyboards.

Strolling over to the desks, it became apparent that these guys were on various stock forums, chatting away with each other!

it seemed that, each screen could have four browser windows, each browser window could potentially be a different alias on some chat board.

With ten of them in that room, they could easily be creating the illusion that some stock was getting a lot of chatter and excitement on some chat boards!

This is part of what IR firms do for companies. They charge tens of thousands of dollars per month for these kind of services.

If you are ever looking at some penny stock and you see 5,10 or 20 people all chatting up that stock, it is likely that those aliases are simply some promotion firm at work!

It is their job to create excitement and generate hype, it is all they do all day, every day.

I have even seen a tactic where one or two guys will pretend to be bearish on a stock and go on the attack, only to be “convinced” later on that the stock is actually very good and will rally soon. The tricks are endless and these guys pros and manipulating emotions

Be ever weary! These IR firms were often paid in tradable stock! I think there are regulations these days which have banned this practice, but there are loopholes to it.

Basically this meant that if you were the CEO of penny stock WXYZ and you wanted to hire this IR firm, you would not write them a cheque for $50,000/month, you sent them a bag full of your shares! If you stock was trading at 10c, this firm would get 500,000 free trading shares. This is a win/win for the penny stock and the IR firm (assuming they do their job).

For the penny stock it means you do not have to lay out any cash, you simply hand out stock which costs you nothing (penny stocks are notorious for increasing the authorized shares, ie dilution). For the IR firm it means that they can potentially make a lot more money than if they were simply paid in cash. Having 500,000 shares @10c means that if they could pump the stock up to 20c, they have basically made $50,000 more! This is why they would game the message boards and farm out the promotional activities to other promoters, to try maximize their gains.

Here again we have another potential reason why a stock can suddenly fall for no reason at all. If this IR firm’s CEO decided he wanted to buy a new Porsche this weekend, he could simply pick a random clients stock that he was no longer working for and dump all the shares he had in it. He does not care about the potential of the company and where the stock was going in six months from now, he simply wants to cash out.

Stock buyer beware, ask a lot of questions and read the fine print!