Eric Noveshen Securities Fraud, Chapter One: Medgen

“Look at the Medgen connection. Funds were laundered through Medgen via consulting fees..Drill inta those underlyin docs that support the 800k…at least a small portion.”

Source – http://www.investorshub.com

If you want to understand a story you have to start at the beginning. Why was Eric Noveshen issued a federal indictment in 2010? How did Eric Noveshen get in a position to loan Automatic Slims over $1-million dollars in 2006? How did Noveshen get so tight with Arthur Robbins? How did Noveshen get in a position to pay Cosi $400,000 for the franchise rights to open shops in South Florida? – Medgen.

We love Investorshub.com – its essential if you want to learn about penny land. In particular these screen names share a wealth of knowledge -Janice Shell, cyberbullymouse, nodummy and renee are just some who post essential information.

We can’t forget pdgood, who once said his info might be early, but it’s never off topic. We should have looked into his advice regarding the Eric Noveshen scam story long ago.

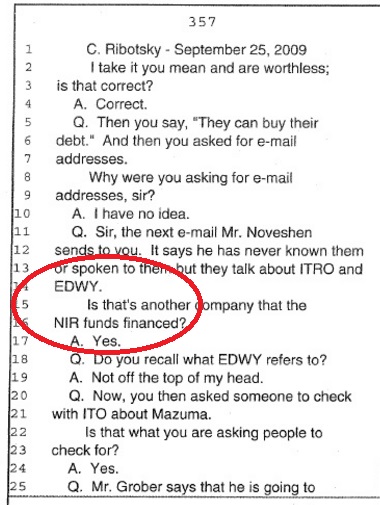

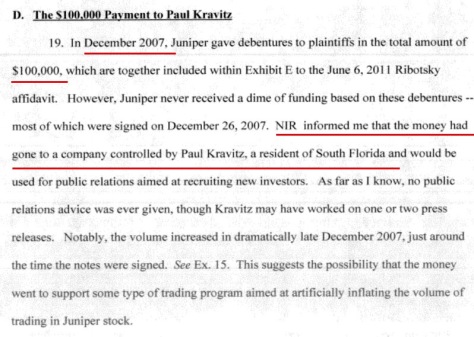

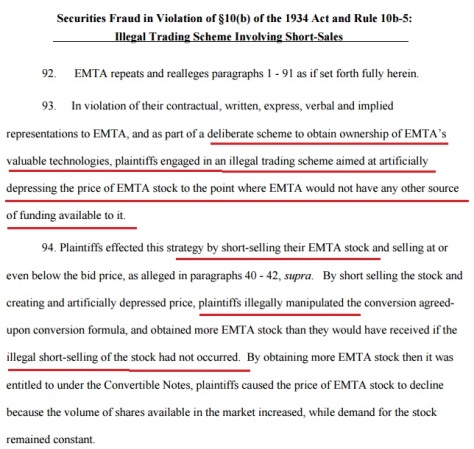

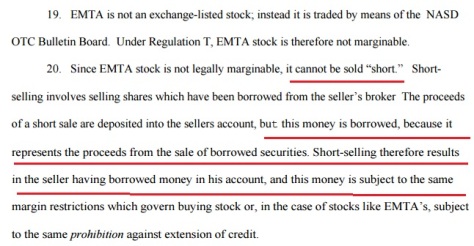

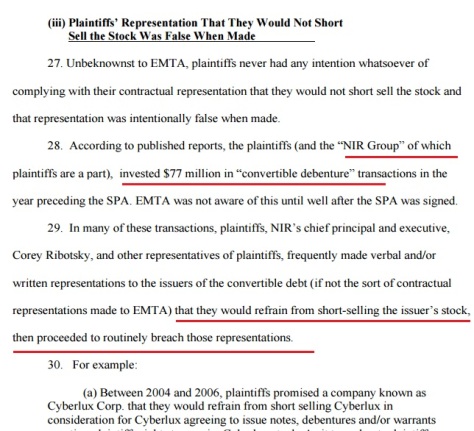

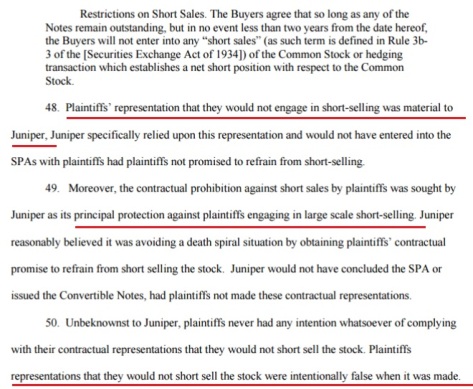

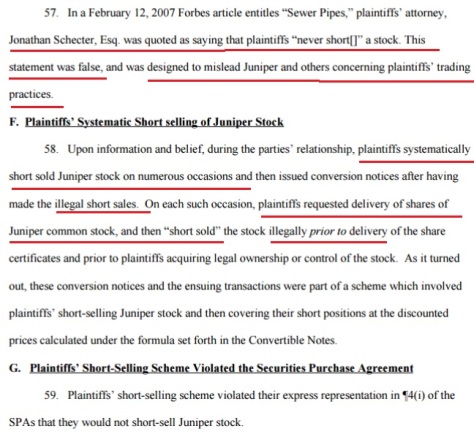

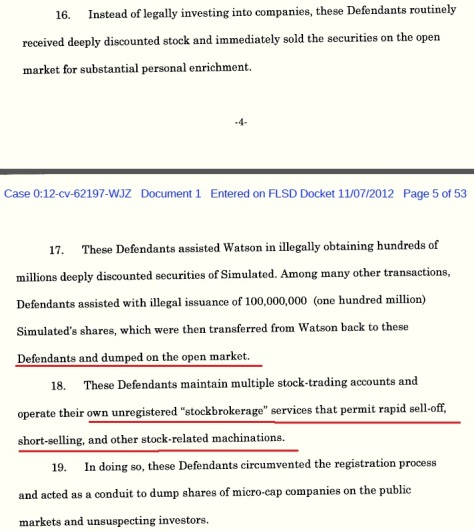

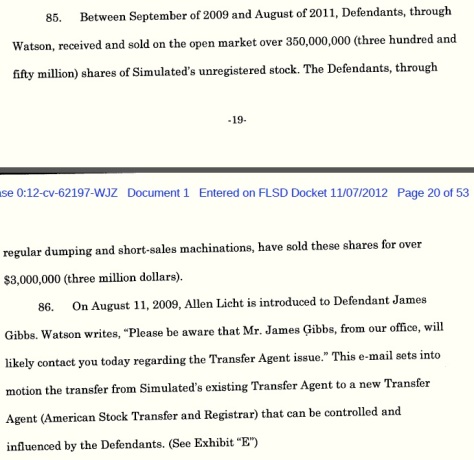

Here’s how Noveshen ended up with all that money. Noveshen was a PIPE deal finder for a New York hedge fund called NIR – that was sued and shut down by the SEC for many securities violations in 2011. Noveshen found small or struggling companies that needed funding. The white knight would offer funding from NIR, with a catch. The company had to pay large fees for PR, to a PR company chosen by NIR.

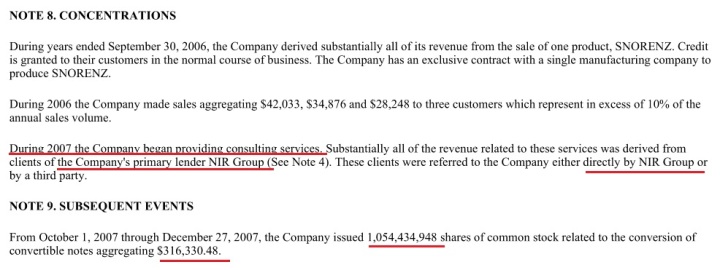

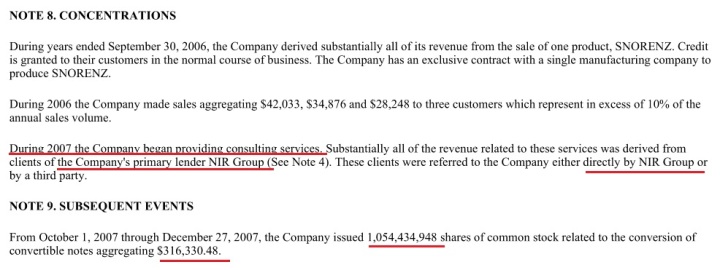

Here’s where it gets twisted. Boca Raton based company Medgen supposedly was “establised to manufacture, sell and license healthcare products” according to a company report below. But they didn’t make money doing that so “management started a Financial Consulting service.” – The PR service NIR required companies they funded to use.

The consulting fees show up in the financial reports that PD said to drill into. He was point on, 100% correct.

Source – http://www.investorshub.com

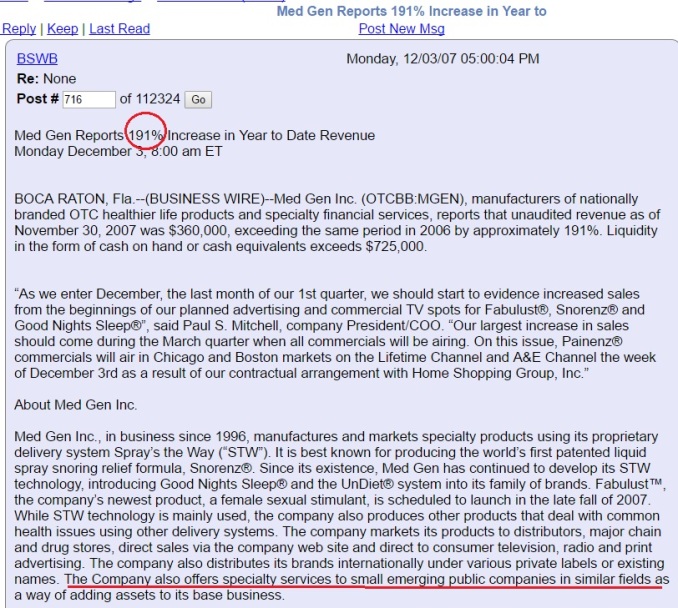

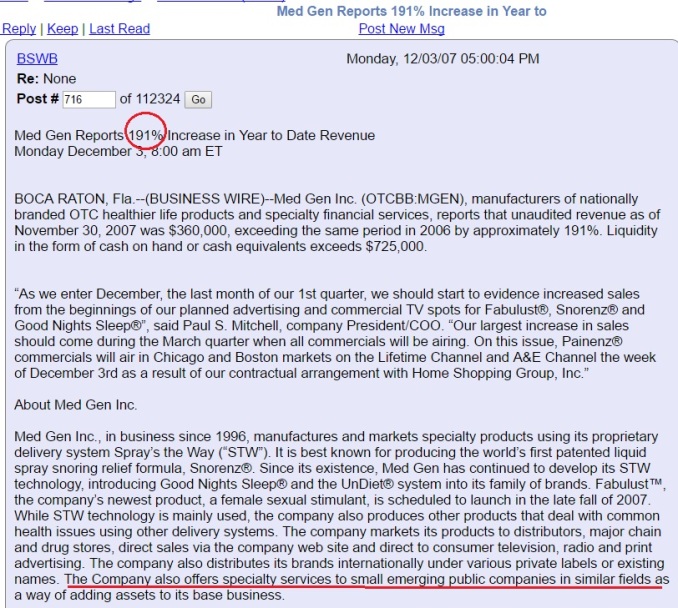

In the end of 2007, Medgen reported a 191% increase in YTD revenue. What? Sounds like those impossible Madoff numbers. But it wasn’t from their BS snoring solution it was from consulting fees laundered through an alternative health product company.

In one quarter there were near $800,000 in consulting fees buried in the report. Noveshen had to kicks some of that back to Daryl Dworkin who was Noveshen’s insider at NIR. In 2010 Dworkin pleaded guilty to taking kickback money from two PIPE deal finders, Eric Noveshen was one of them.

http://www.forbes.com/sites/streettalk/2010/07/08/former-nir-group-analyst-pleads-guilty-to-securities-fraud/#27be74c47074

What a scam huh? We told you Noveshen was a great financial scam artist. Read em for yourselves here:

medgen ending 2007

Medgen report 2008

2nd quarter ended 3/31/08, Product sales: $72,937 Fees Consulting Services: $419,411 ??

Did no one think it odd that a company that produced natural health care products suddenly added “consulting” and “PR services” and revenues suddenly shot up 191%?

Our information might be early, it might be late, but it is never off topic. When Noveshen tells you this site is full of hogwash “drill” into the documents for yourselves folks. Wish we had long ago. If we can save one person from being defrauded by Eric Noveshen then we can sleep at night without Snorez!

We wonder, the federal indictment that Noveshen got sealed by rolling on NIR’s Daryl Dworkin in 2010, was Noveshen exonerated of all the money laundering through Medgen too or was he just let off the hook for paying kickbacks to Dworkin? Pocketing a nice cut of $800,000 a quarter for a year isn’t chump change.

As pd said, “THE OCTOPUS HAS MANY TENTICLES” – Noveshen’s financial scams are still going on, this very day in June 2016. Don’t get played by this financial playa!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81487405

Why did the US Attorney General, SEC & DOJ let Eric Noveshen walk after having him on paying illegal kickbacks to NIR Hedge Fund?