To understand a story you need to dig at the roots. Check out this 2009 article from Forbes. Remember, Eric Noveshen was a PIPE dealfinder for NIR. Has Noveshen disputed that?

Has Noveshen disputed that?

To understand a story you need to dig at the roots. Check out this 2009 article from Forbes. Remember, Eric Noveshen was a PIPE dealfinder for NIR. Has Noveshen disputed that?

Has Noveshen disputed that?

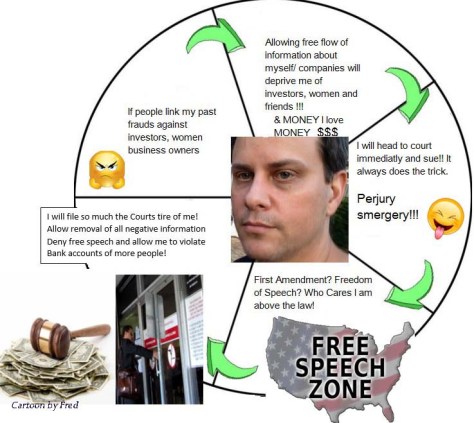

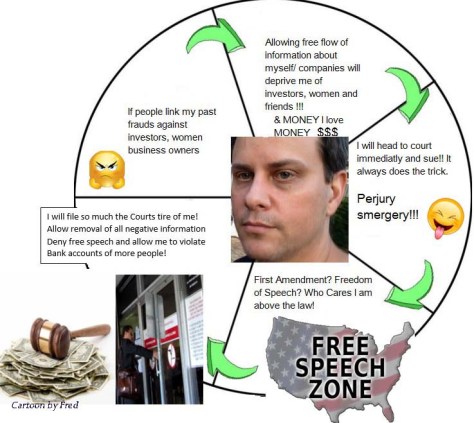

This site is intended for the sole purpose of providing due diligence on investment advisor Eric Noveshen. To provide background and education to potential clients. All of the content comes from relevant PUBLIC SOURCES – gathered in one place so people can decide for themselves if they feel comfortable with this individual handling their money.

Did the men running micro stock Pure Hospitality Solutions miscalculate when they allowed Eric Noveshen manipulate a financial report to meet the needs of the defamation lawsuit he filed this year?

Noveshen had a hand in falsely writing into quarterly and annual financial disclosure reports for PNOW that the company severed ties with him. “The company unilaterally determined to retroactively terminate the consulting agreement with this consultant due to certain groups of individuals that are posting false and defamatory attacks about the company which are somehow tied to this consultant.”

Read it out loud, it is not only out of place it shows that they allow manipulation of financial reports. Thus adding credibility to hundreds of online claims made during the last four years that PNOW is a penny stock that has manipulated financial disclosure.

It’s no secret that Noveshen and his longtime friend and business associate Ajene Watson are part of the consulting team pulling the strings behind the penny stock PNOW. It’s been documented all over for years before Noveshen claims the “false and defamatory remarks” were put on the internet about him.

Hey, Noveshen needs to add a few words to a company financial report to make a court believe he had damages, no big deal, anything for a friend.

In allowing PNOW to become part of Noveshen’s case is like putting it on trial for being a pump and dump. At very least it keeps PNOW in the public discussion and knows when the SEC or FINRA started looking.

The lawsuit that crawls under Noveshen’s skin due to all the public commentary about it on the internet is called Allen v. Ajene Watson, et al. It was filed in Florida in 2012 and internet commentary began immediately and never stopped.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=102223261

That lawsuit detailed how Noveshen, Watson and others sweet talked their way into becoming the “consulting team” for penny stock company Simulated Environment Concepts, SMEV, in 2009, then set in motion a “pump and dump” scam. It also states that the group, including Noveshen and Watson did similar scams on other companies, Edoorways, EDWY and Oriens Travel – which changed its name in 2014 to Pure Hospitality Solutions, PNOW. Likely because the owner of the company, Allen Licht was acting as his own lawyer, it goes into the most minor details of how they pulled off the scam. Including inserting a transfer agent who would play ball, Christopher Day, (who recently got in trouble with the SEC). They also “inserted” Noveshen’s mother as the book keeper.

These facts and opinions have been written about since 2012. Is Noveshen going to sue everyone who ever wrote that Edoorways, Simulated Environment Concepts and Pure Hospitality Solutions were pump and dump scams? If so he needs to add a lot of names to the defendant list.

What a hoot!

** Below, readers thoughts on the subject

“This is NOT AT ALL a good thing for Gary or EDWY. Ajene Watson was a “consultant” for EDWY, so they really cannot claim ignorance on this one.”

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81345633

“This makes me happy that the scum that have been doing this are getting busted, but I do feel bad for the innocents that will learn about stinky pinkies the hard way.

All someone has to do is read the lawsuit. Again has nothing to do with edwy. Mentioned that edwy was a victim. The whole thing is much to do about nothing really. Just noise.

See GARY was 100% RIGHT HERE! EDWY has nothing to do with that lawsuit first off. You cant twist this any other way.

Remember back 3 years ago when watson and Ian mitchel tried to take over EDWY. EDWY’s complaint was a failed take over attempt. This just adds to Gary’s claim about these scum bags. Now here is proof about the whole thing. Watson and Mitchel are apparently getting theres. Karma is a b*tch!

Its seems someone else had problems with these guys, not just EDWY.

More proof! Makes me feel good!”

OOPS…. Eric Noveshen did it again! Charged thousand$$ on his American Express Card, sent them a check that bounced and now is being sued for the second time by American Express.

Any guesses how Noveshen will handle this one? Will he deny part of the bill is his like he did in 2008 when he lied and said close to $20,000 was fraud? Will he get his pro se litigant guns loaded and head to the Broward Court house and embark on another six year legal battle with American Express?

Did Noveshen ever pay off the last American Express judgment? That judgment was for over $80,000 he and his mother charged but refused to pay. Noveshen played the system to get it knocked down to $30,000. More fees for Amex holders who actually pay their bills!

For more information from the last American Express lawsuit against Eric Noveshen and his mother read here:

The purpose of this blog is explained in more detail below and has always been available. Some are not fond of the research we provide on Eric Noveshen. We received another anonymous threat today:

Dear Anonymous threat, this blog is not about “ONE GUY.” This blog is not intended to help or harm Eric Noveshen. It is intended to potentially help thousands of investors in the microcap stock market that might invest in a penny stock Eric Noveshen is behind. It is also intended to provide background that potentially helps other investors, individuals and financial institutions such as mortgage lenders and credit card companies considering doing financial business with or providing loans to Noveshen.

No it would not be worth it if this was about ONE GUY. This blog is about THOUSANDS of INVESTORS, LENDERS and INDIVIDUALS who could fall victim to one of his scams. Are thousands of people worth it? You be the judge.

![]()

The NAICS classifies Eric Noveshen’s company Envision Capital LLC of Fort Lauderdale, FL a provider of “Investment Advice.” When an “investment advisor,” broker, firm, etc, is not registered with FINRA consumers have almost no collective source of information to decipher if it is safe to do business with the company. Investors of all income levels should have the right to relevant information about anyone managing their money or giving advice about their money. In this case, Noveshen WAS a registered broker up until 2003 or 04. According to its website, “FINRA also provides the public with access to relevant information about formerly registered brokers who, although no longer in the securities industry in a registered capacity, may work in other investment-related industries or may seek to attain other positions of trust with potential investors. Through its BrokerCheck service.” Noveshen hasn’t been registered in over TEN years. The information FINRA provides is extremely relevant, 10 years of no oversight leaves an incomplete picture of Noveshen. This website is intended to do no more than provide background information on Mr. Noveshen to individuals and companies who may be looking to do business with him.

To answer the question posed to us on Sun. June 19, yes we are happy to post submissions from guest bloggers. Blogs must be based on credible information and documentation such that the content is accurate and true.

Presented below, a letter written to Jack Boyle of Ft Lauderdale, FL in January 2015 by the grandmother of Eric Noveshen, Estelle Hartman. As stated in the letter Hartman learned that multimillionaire Jack Boyle, in his 80’s, had employed her grandson Eric Noveshen. Hartman issued a warning to Boyle about loaning money to Noveshen and some other interesting information that all investors and business clients should have the right to consider. We have reviewed and there is documentation available to support the warnings and entire Hartman letter. God bless this poor woman. *Names of children have been removed.

Why did Daryl Dworkin have to pay back the $375,000 kick back money and fines but Noveshen didn’t have to pay a dime of restitution?

Why are two men guilty of the same securities crimes but only one is sentenced and fined?

Why was Eric Noveshen’s cut of the Medgen money laundered “consulting fees” left for him to enjoy? Did he even pay taxes on that money? Probably not, he’s allowed to commit tax evasion too? Noveshen has some serious power with the SEC and IRS, not even an hand slap.

Does the SEC and Dept. of Justice know or care how many investors have been hurt in six years since they let Eric Noveshen walk away from his criminal acts? Check with investors in these microcap stocks ….EDWY, SMEV, SLGS, PNOW (formerly OTHM), HIMR, GAHC, BMIN and more.

Transcript from United States of America v. Daryl Dworkin

Even when scammers have money they enjoy the challenge of getting out of paying their bills. Just ask attorney Barry Franklin. He got the judgment against Noveshen below in 2011 he didn’t pay it off until 2015.

Franklin Order Contempt Noveshen 2011

Noveshen didn’t want to pay $3,000 he owned him, but he made that in a weekend at Slims? Those trips to Court seem to give him a high, tho, going through the attorney only door and all.