The purpose of this blog is explained in more detail below and has always been available. Some are not fond of the research we provide on Eric Noveshen. We received another anonymous threat today:

Dear Anonymous threat, this blog is not about “ONE GUY.” This blog is not intended to help or harm Eric Noveshen. It is intended to potentially help thousands of investors in the microcap stock market that might invest in a penny stock Eric Noveshen is behind. It is also intended to provide background that potentially helps other investors, individuals and financial institutions such as mortgage lenders and credit card companies considering doing financial business with or providing loans to Noveshen.

No it would not be worth it if this was about ONE GUY. This blog is about THOUSANDS of INVESTORS, LENDERS and INDIVIDUALS who could fall victim to one of his scams. Are thousands of people worth it? You be the judge.

If the Courts believe there is anything wrong with this blog issuing warnings to investors, lenders and regular joes, based on-and backed up by concrete documentation we will take it down. And Eric Noveshen can laugh all the way to the bank with more money from new investors and lenders.

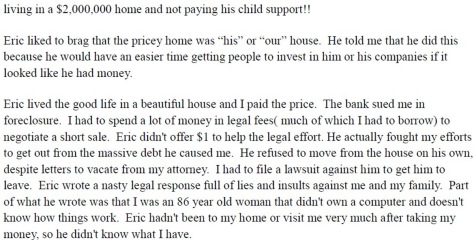

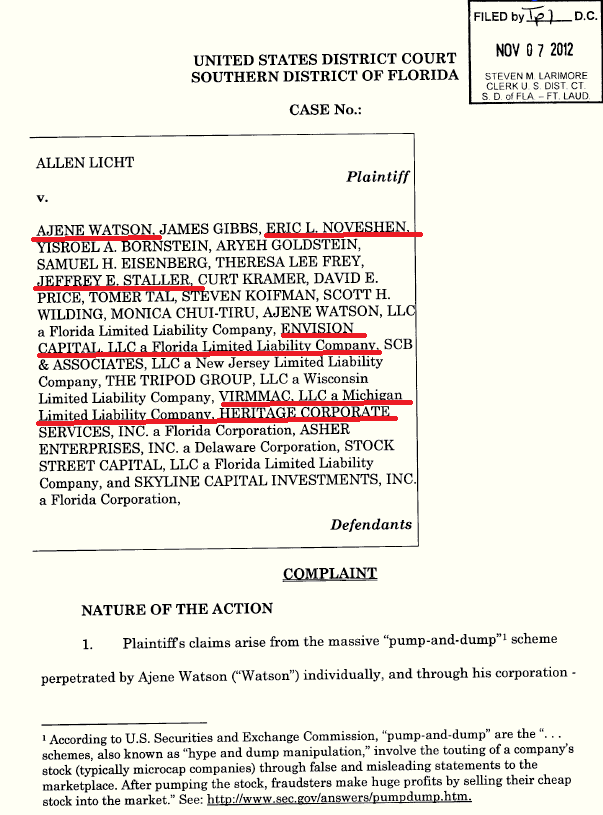

New victims will end up in court trying to recover their money from Noveshen. Ask American Express, Citibank, KRG/Pem. Pines, Northstar Mortgage, Christina Carter, Paul Carter, Margaret Welter, Adam Shuman, Ralph Desiano, Barry Franklin, Allen Licht, Wakefield Quinn and Eric’s own biological grandmother Estelle Hartman how much fun it is to chase Eric Noveshen around to recover money he owes or took! — Good Luck!!!

![]()

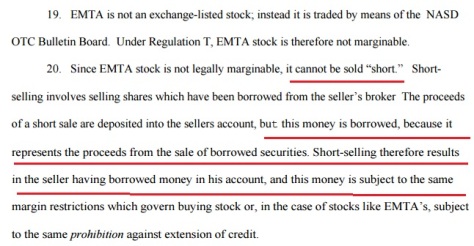

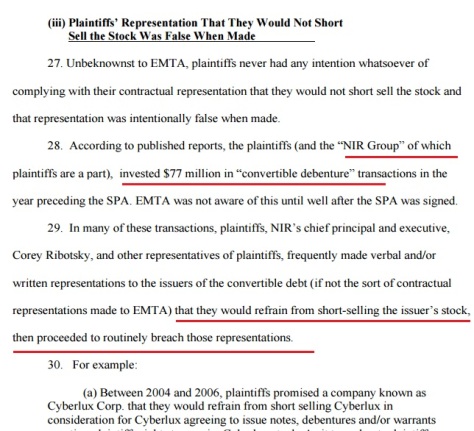

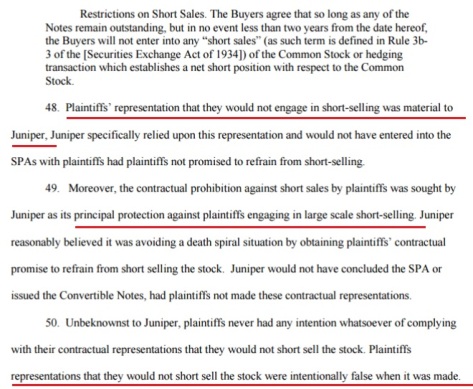

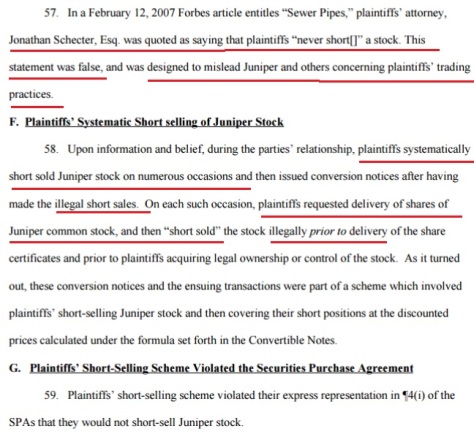

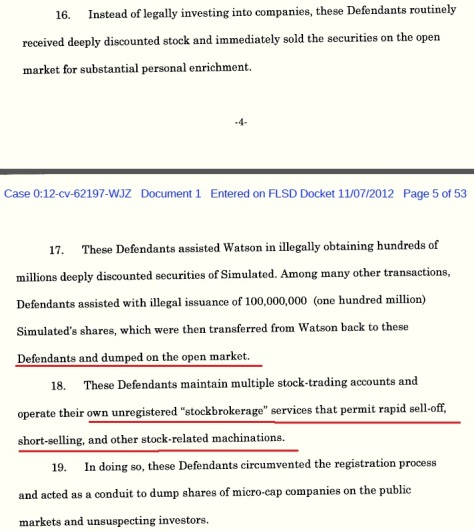

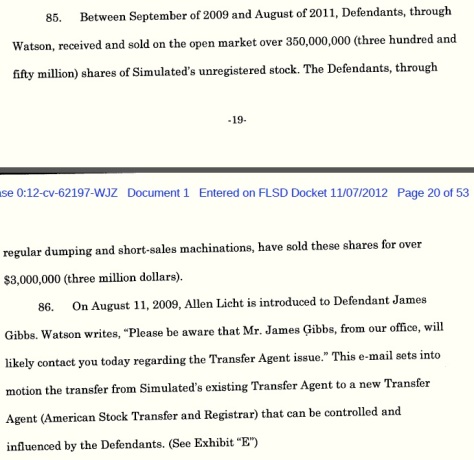

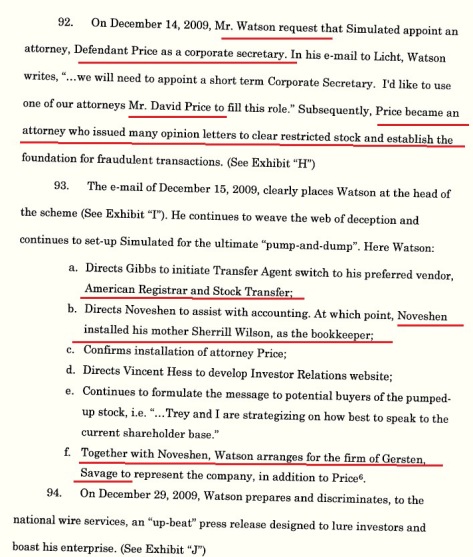

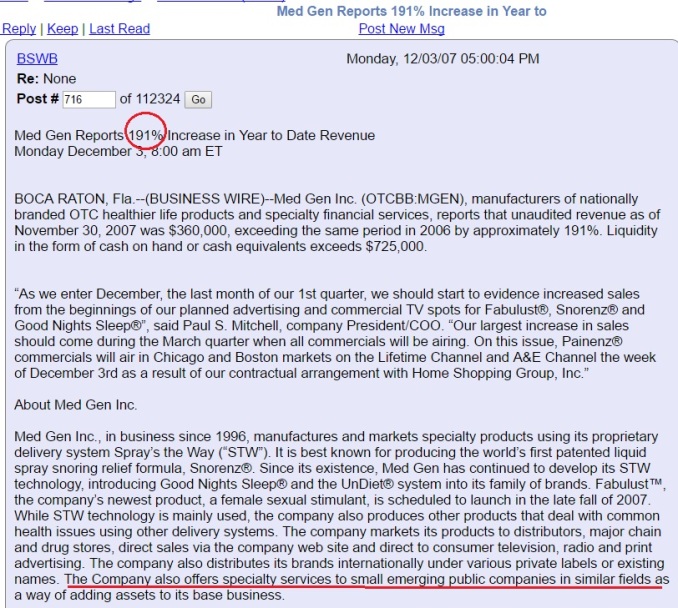

The NAICS classifies Eric Noveshen’s company Envision Capital LLC of Fort Lauderdale, FL a provider of “Investment Advice.” When an “investment advisor,” broker, firm, etc, is not registered with FINRA consumers have almost no collective source of information to decipher if it is safe to do business with the company. Investors of all income levels should have the right to relevant information about anyone managing their money or giving advice about their money. In this case, Noveshen WAS a registered broker up until 2003 or 04. According to its website, “FINRA also provides the public with access to relevant information about formerly registered brokers who, although no longer in the securities industry in a registered capacity, may work in other investment-related industries or may seek to attain other positions of trust with potential investors. Through its BrokerCheck service.” Noveshen hasn’t been registered in over TEN years. The information FINRA provides is extremely relevant, 10 years of no oversight leaves an incomplete picture of Noveshen. This website is intended to do no more than provide background information on Mr. Noveshen to individuals and companies who may be looking to do business with him.