Is Eric Noveshen still denying that he has ever been involved with microcap stock fraud? -Noveshen keeps insisting he was never involved in a pump-and-dump stock scam. Did he forget about Itronics? It was a long time ago but he can’t even remember that he’s involved with Pure Hospitality Solutions, as of, when was the last deposit he got from selling shares of PNOW? Likely within the last couple months. Investors pay consultants of penny stocks, get no return and are forgotten – quickly. Don’t be a victim.

Category Archives: Pump and Dump Stock Scam

“You Up Ta Speed on Shorting?”

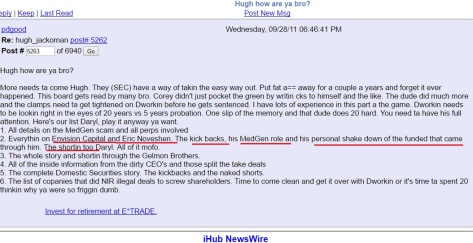

Yesterday’s blog, “Eric Noveshen’s Biggest Financial Scam Money Laundering Through Consulting Fees” generated a lot of emails. One claimed to have been a victim of the NIR, Daryl Dworkin, Eric Noveshen, Medgen PR scam. Almost any email of relevance said look at the pattern of shorting.

Eric Noveshen’s Biggest Financial Scam – Money Laundering Through Consulting Fees

This is what Pdgood said on http://www.investorshub.com too, “You up ta speed on shorting? Eric wants no part of the questions that would be asked about Medgen, Robins as CEO of ECMH…Eric was front and center in all these scams.”

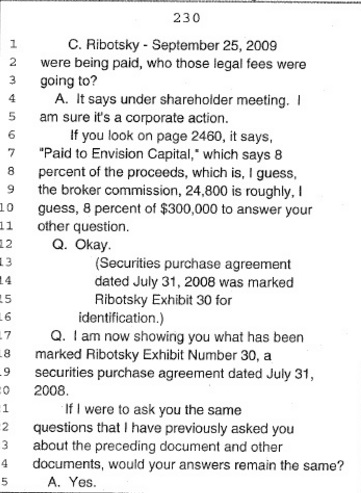

As explained, Noveshen was a PIPE deal finder for a New York hedge fund NIR. Noveshen found small or struggling companies that needed funding. He would offer funding from NIR, with a catch. The company had to pay large fees for PR, to a PR company chosen by NIR. That company was Boca Raton based Medgen, a money laundering factory disguised as a producer of holistic health products.

The PR money was and split between Dworkin of NIR, Noveshen of Envision Capital, and Paul Kravitz head of Medgen.

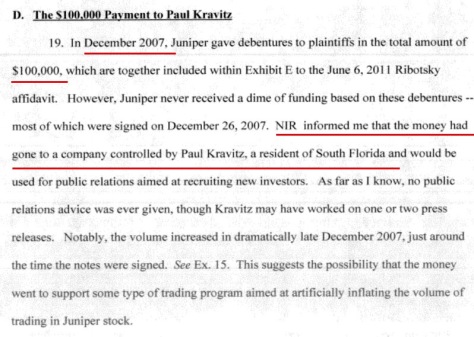

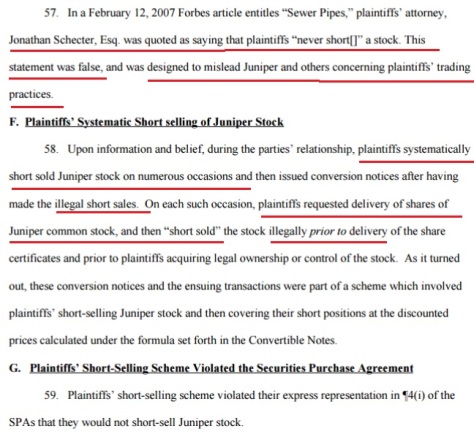

From the affidavit of the CEO of the Juniper Group, an NIR (AJW Funds) funded company confirmed that the funded companies were required to pay money to Medgen (Paul Kravitz) for “PR” and “Consulting”.

AJW QUALIFIED PARTNERS, AJW MASTER FUND… v. JUNIPER GROUP, INC.

Source: http://www.investorshub.com

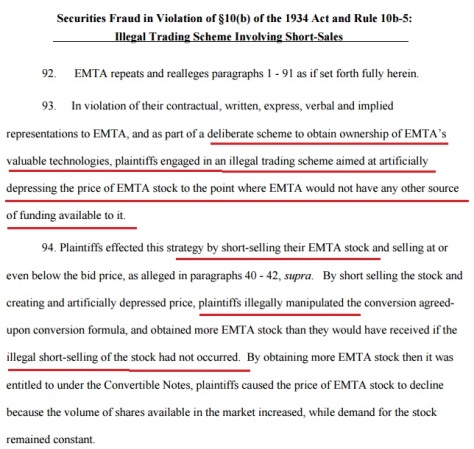

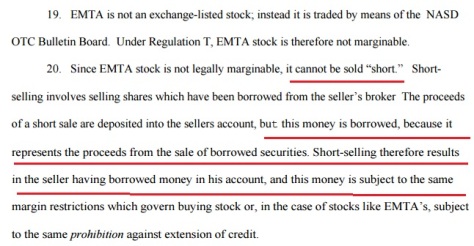

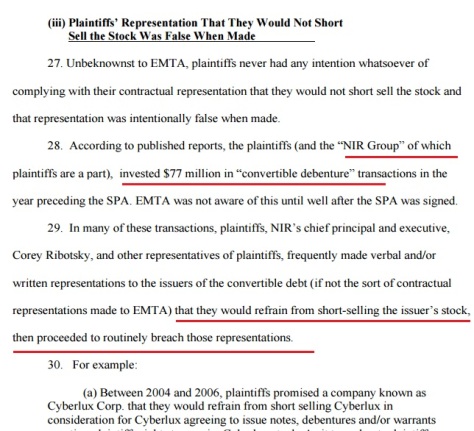

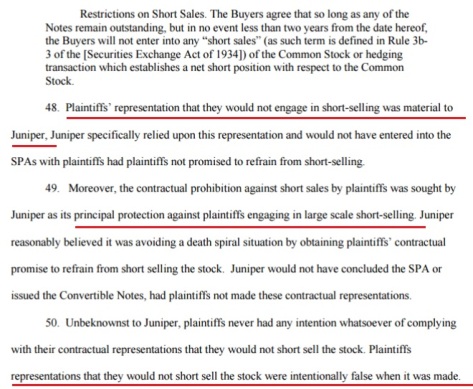

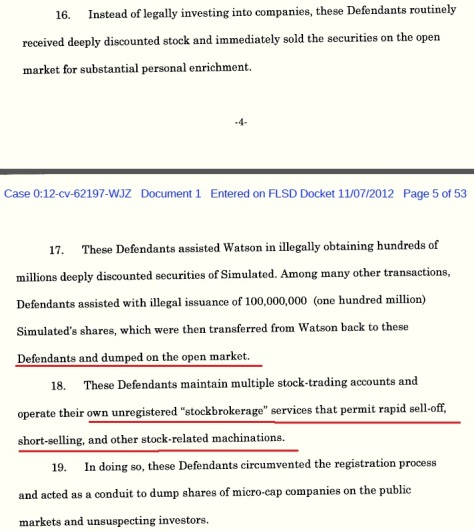

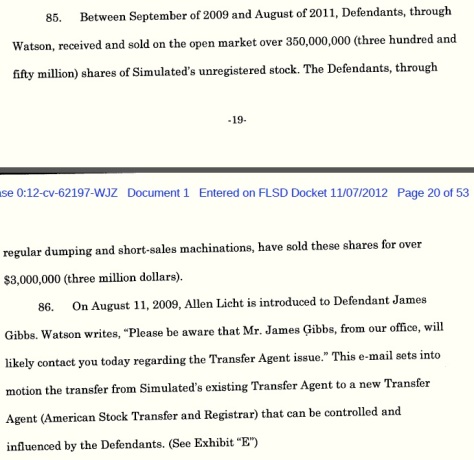

NIR illegally shorted a long list of stocks of the companies it funded. The pattern of shorting and other securities frauds committed by NIR is spelled out in many lawsuits against NIR and its AJW Funds. Note* it fits the same pattern of stock manipulation that Ajene Watson and Eric Noveshen are accused of in the Simulated Technologies/Licht v. Watson lawsuit.

Read for yourselves….very similar illegal patterns. Dworkin and Ribotsky are out of the game for a few years, but Ajene Watson and Eric Noveshen have carried on these stock manipulations in other stocks such as Oriens (OTHM), changed name to Pure Hospitality (PNOW) in 2014. Stock fraudster hospitality, if you’re an investor you’ll never forget it.

EMTA Holdings, INC. v. AJW PARTNERS, AJW OFFSHORE,…..

Juniper Group v. AJW QUALIFIED PARTNERS; AJW MASTER FUND..

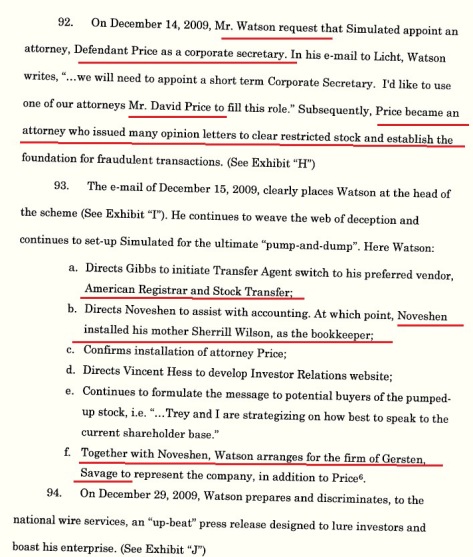

Allen Licht v. Ajene Watson, et. al

More details of this case found here:

More information on stock shorting:

Regulators Investigating Firms Sub-Account Use in Shorting Stocks

Memorial Day Reminder -Recognize Red Flags of Stock Scams

On this day we salute those who gave all. A message to those who “take all” – stock fraud is very unpatriotic.

Defrauding fellow Americans and other investors around the world might make you nice living, but ever think about the livings of those you are scamming? Maybe its a war hero? Did he or she lose a limb? Did he or she just get back from duty in Afghanistan while you sat behind a computer posting fake hype to get him to invest in a shell you stuffed a fake company in? Maybe that $5,000 invested in your penny stock means nothing to you but is half of someones retirement?

Note to investors: perpetrators of stock fraud do not care. REPORTERS, the SEC, FINRA, POLITICIANS and the COURTS can’t catch all the microcap stock fraud so educate yourselves before investing.

https://www.investor.gov/investing-basics/avoiding-fraud/types-fraud/microcap-fraud

https://www.law.cornell.edu/wex/investor_protection_guide_micro-cap_stock_fraud_pump_and_dump

Why Reporting On Stock Manipulation Is Important

Investors Beware! Microcap stocks are risky, ‘the odds are stacked against you.’

Stock fraud has devastating effects on victims and thus, reporting on stock fraud is extremely important.

On January 29, 2010, the FBI published a story about a ten year investigation into pump-and-dump stocks scams. The investigation uncovered more than 40 schemes, convicted 40 perpetrators, identified thousands of victims in nearly every state and discovered hundreds of millions of dollars in losses.

That pump-and-dumps target elderly investors is no secret. That the FBI can’t keep up with the pace of pump-and-dump scams is no secret, they sprout like “mushrooms.” That perpetrators of stock fraud don’t want coverage of their actions is common sense. If information is easy to obtain in a simple google search, less people will fall victim.

https://www.fbi.gov/news/stories/2010/january/fraud_012910

From the FBI story:

How do these scams work? In this case, the ringleaders created shell companies whose penny stock (worth less than $5 a share) was traded on the OTC Bulletin Board (not on the more widely known New York Stock Exchange or NASDAQ). They secretly issued most of the shares for themselves in fictitious names, then touted their companies’ stock through false statements in press releases, electronic bulletin board postings, online newsletters, and the like.

Often using their retirement funds, unsuspecting investors purchased the highly-touted stock—or their unscrupulous financial advisors did so without their knowledge—driving or “pumping” up the price. Then, the fraudsters “dumped,” or sold, their stock for thousands or millions of dollars, causing the stock to plummet and innocent investors to lose their shirts.”

In many cases, the losses were significant. And while running an undercover operation and gathering enough evidence to put the criminals behind bars, our focus has been on helping victims get some of their hard-earned money back. We spent years interviewing more than 600 mainly elderly victims, painstakingly documenting their sometimes heartbreaking losses. For example:

- We assisted a doctor from a prestigious hospital who began suffering from severe depression after learning of the scam and became unable to work. To help a husband and wife who had both developed dementia during the investigation, our agents traveled to their nursing home and spent hours with them, their family members, and their accountants to substantiate their financial losses.

- We worked with a man suffering from multiple sclerosis whose stockbroker had liquidated his pension and IRA and left him nearly penniless.

- We learned of another victim who not only invested her savings and her pension, but also took out a second mortgage to invest more. Needless to say, she lost everything.

An investment blog on Reddit offered a behind the scenes look at the inner workings of one particular IR (investor relations) company – that was a pump-and-dump shop. “Stock Jockey” states, “The “odds are stacked against you right from the beginning. In your efforts to do some research on a penny stock, you may find yourself reading some forums and thinking you are getting unbiased opinions. You are not!

IR companies often handle investor relations for a large number of small cap stocks. People usually don’t get to see what really goes on. In the back office of one particular IR company there was a large space dedicated to about ten desks that had a computer and 2 screens on each desk. There were ten young guys all tapping away on their keyboards.

Strolling over to the desks, it became apparent that these guys were on various stock forums, chatting away with each other!

it seemed that, each screen could have four browser windows, each browser window could potentially be a different alias on some chat board.

With ten of them in that room, they could easily be creating the illusion that some stock was getting a lot of chatter and excitement on some chat boards!

This is part of what IR firms do for companies. They charge tens of thousands of dollars per month for these kind of services.

If you are ever looking at some penny stock and you see 5,10 or 20 people all chatting up that stock, it is likely that those aliases are simply some promotion firm at work!

It is their job to create excitement and generate hype, it is all they do all day, every day.

I have even seen a tactic where one or two guys will pretend to be bearish on a stock and go on the attack, only to be “convinced” later on that the stock is actually very good and will rally soon. The tricks are endless and these guys pros and manipulating emotions

Be ever weary! These IR firms were often paid in tradable stock! I think there are regulations these days which have banned this practice, but there are loopholes to it.

Basically this meant that if you were the CEO of penny stock WXYZ and you wanted to hire this IR firm, you would not write them a cheque for $50,000/month, you sent them a bag full of your shares! If you stock was trading at 10c, this firm would get 500,000 free trading shares. This is a win/win for the penny stock and the IR firm (assuming they do their job).

For the penny stock it means you do not have to lay out any cash, you simply hand out stock which costs you nothing (penny stocks are notorious for increasing the authorized shares, ie dilution). For the IR firm it means that they can potentially make a lot more money than if they were simply paid in cash. Having 500,000 shares @10c means that if they could pump the stock up to 20c, they have basically made $50,000 more! This is why they would game the message boards and farm out the promotional activities to other promoters, to try maximize their gains.

Here again we have another potential reason why a stock can suddenly fall for no reason at all. If this IR firm’s CEO decided he wanted to buy a new Porsche this weekend, he could simply pick a random clients stock that he was no longer working for and dump all the shares he had in it. He does not care about the potential of the company and where the stock was going in six months from now, he simply wants to cash out.

Stock buyer beware, ask a lot of questions and read the fine print!

Microcap companies – SEC Says Check Out People Running The Company

The SEC, in a page designed to help those interested in investing in Microcap stocks advises people to check out the people running the company. What happens when that information is concealed? Investors often feel the rub.

Microcap companies – What’s So Important About Public Information?

In the microcap world, consultants or people who lend money to micro companies who then can’t pay the debts back then have to pay in large blocks of stock, which they usually sell off fast and drive the price of the stock to nothing. Often, the same consultants and lenders go from company to company repeating the same frauds. Investors have a right to know the history of an individual in control of their money. If an individual has any ties to past scam companies, this information is either totally concealed or hard to find.

“Of potentially greater concern is that the lack of reliable, readily available information about some microcap companies can open the door to fraud. It’s easier for fraudsters to manipulate a stock when there’s little or no information available about the company.”

“Publicly-available information about microcap stocks, including penny stocks often is scarce. This makes it easier for fraudsters to spread false information. In addition, it is often easier for fraudsters to manipulate the price of microcap stocks because microcap stocks historically have been less liquid than the stock of larger companies.”

Before investing in a microcap, the SEC advises:

- Read carefully the most recent reports the company has filed with the SEC and pay attention to the company’s financial statements, particularly if they are not audited or not certified by an accountant.

- Check out the people running the company with your state securities regulator, and find out if they’ve ever made money for investors before. Also ask whether the people running the company have had run-ins with the regulators or other investors.

Who pulling the strings inside a company is a significant information that investors in all types of publicly traded companies should have the right to. But often if you read the fine print of a financial report you will find a statement like these: (pulled from real reports)

“On September 4, 2015, the Company entered into a consulting agreement, effective October 1, 2015, for an initial term of three months”

“the Company entered into consulting agreements with four sons of its President, for their respective consulting services at a rate of $29,000, respectively.”

With Who? Or the consulting agreement will be with a company, you have no idea who the actual people are you’re giving your money to. If you look up the company it can be some ambiguous company registered to another company.

Information is investors best weapon against fraud. Fraudsters don’t want their information public.

This is why we support reporters like Teri Buhl, be thank ful for her trademark “Smashmouth Investigative Journalism” probing and asking the questions and reporting stories fraudsters don’t want told. She dug deep into the NIR debocal that caused investors to lose millions that the government could never recover. All this is relevant to this site because of NIRs storied PIPE deal finder Eric Noveshen – knowing the players is important when thousands of people have their money on the line.http://www.teribuhl.com/2011/11/23/pwc-says-nir-group-doesnt-have-access-to-dealer-market/

Some of the comments posted on her reports:

I have lost a huge portion of my retirement in the NIR fund, AJW Offshore. Corey Ribotsky seems to be doing well and I need to contact him regarding my losses. I need Corey’s phone or email address. Help!

December 9, 2011 at 1:06 pm

Can you please look into the NIR payment arrangement with the Itronics settlement.

I think you’ll be startled at what you uncover. In a nutshell, Itronics has been committing fraud on multiple levels. They agreed to settle with NIR for $8M+ payable in shares or cash. The company has zero cash yet they only added about $600k worth of shares to their outstanding share count since the May 4, 2011 payout commencement date. This means NIR is being paid in something other than just shares. It’s widely speculated that ITRO is grossly understating revenues and selling silver off the books to pay this settlement or some other nefarious scheme. Perhaps they have a deal with silver? Nobody knows for sure but I’d bet my bottom dollar that NIR is receiving dirty money from ITRO and may very well be complicit in the scheme.

Itronics the good ole fertilizer company, Eric Noveshen had his hand in that cookie jar. Last year he claimed he wasn’t connected to NIR, for good reason, but don’t investors have the right to know? https://www.sec.gov/litigation/litreleases/2011/lr22106.htm

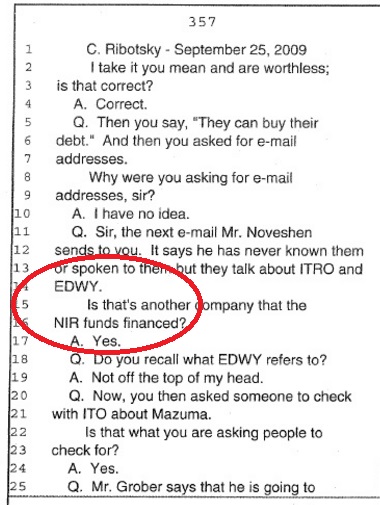

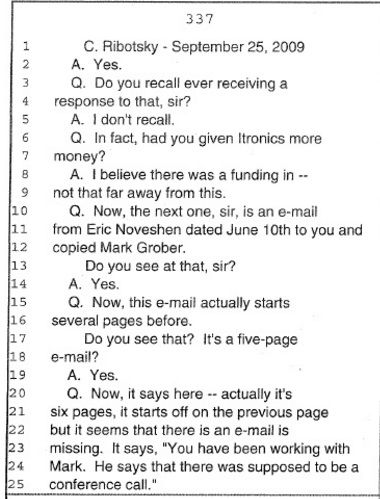

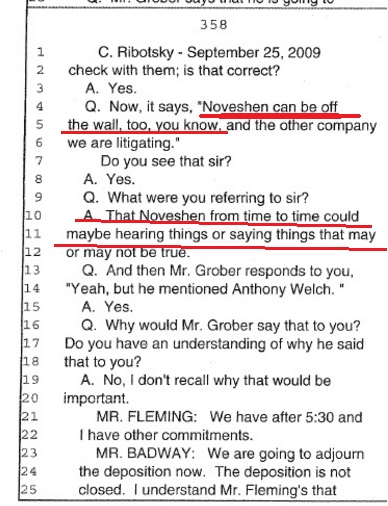

From a 2009 deposition of Corey Ribotsky:

Curt Kramer? Connect the dots again…Noveshen worked with Kramer in a pump and dump of a Florida based company, SMEV that resulted in a federal lawsuit in 2012, Allen Licht v. Ajene Watson et. al (Noveshen was a defendant). Bet Allen Licht wish he knew this information prior to signing a deal with him.

Curt Kramer was blacklisted by FINRA in 2013.

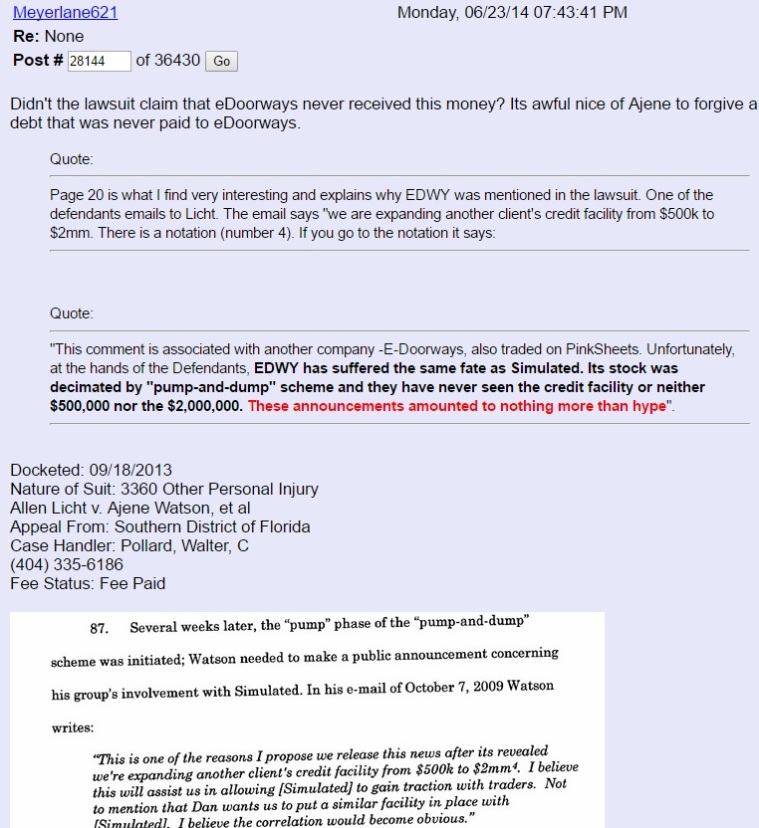

EDWY, edoorways – another pump and dump Noveshen benefited from in 2009-10, as noted in Allen Licht v. Ajene Watson et. al. Warning: the circle isn’t too big folks.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103620719

Eric Noveshen Fits Right in Fraud Capital

Eric Noveshen is in good company. According to Fortune magazine and the AP, Florida is the United States capital of Fraud. Maybe that’s why Noveshen hasn’t been caught yet. Every dog has its day, but until he is stopped read up and keep yourself safe from his scams.

http://fortune.com/2015/07/29/south-florida-fraud/

“Shady dealings run amok in sunny South Florida where creative crooks are coming up with scams of every sort, from fake Jamaican lotteries to basic identity theft.

The three-most populous counties in southern Florida, Miami-Dade, Broward and Palm Beach, are rife with underhanded deals that steal millions from governments, banks and individuals, reports the Associated Press.” – Fortune magazine

Signs of A Noveshen Financial Scam

A previously covered topic and one we get many emails on is the pump-and-dump of the Florida based company Simulated Environment Concepts stock, (SMEV). The lawsuit, Licht v. Watson, et. al, S. Florida CASE # 0:12-cv-62197-WJZ, holds valuable information for anyone considering doing business with Eric Noveshen and should give it a good read.

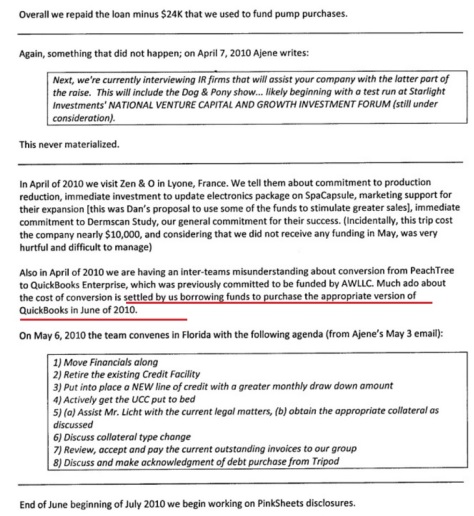

Warning signs; Noveshen surrounds himself with the same names; transfer agents, financiers, attorneys, stock promotion teams and Noveshen’s friends / family. Noveshen and Ajene Watson have done consulting services together for many pink sheet companies. They both worked with the now defunct NIR Group, NIR provided funding for Edoorways (EDWY) a deal worked on by Noveshen and Watson. The Licht lawsuit claimed,

“Unfortunately, at the hands of Defendants, EDWY has suffered the same fate as Simulated. Its stock was decimated by pump-and-dump scheme…”

Curt Kramer/ Asher Enterprises, notable for connections to Novehsen via NIR, also makes an appearance in the Licht lawsuit. Kramer was blacklisted by FINRA in 2014 after being ordered to pay $1.4 million in 2013 to settle SEC charges that he purchased billions of shares of two penny stock companies and failed to register them before reselling them to investors.

The biggest danger, is when Noveshen brings family to work . The Licht lawsuit states, in December 2009, “Noveshen installed his mother Sherrill Wilson, as the bookeeper;” *Her name is Cheryl not Sherrill

The next step was to move the company accounting books out of Plaintiff Licht/ Simulated’s view. Noveshen was part of the team urging Licht /SMEV to move away from their current accounting system, Peachtree to Quickbooks giving Noveshen’s mother Cheryl Wilson greater opportunity to doctor the financials.

A cautionary tale; as in December 2014 Noveshen became President of a health insurance audit company called Microvu. Same scam, Noveshen installed his mother Cheryl Wilson to aid him in diverting funds from the company and cook the books.

Read closely, neither Licht /SMEV or the owners of Microvu knew that Cheryl Wilson is Eric Noveshen’s mother, Noveshen went out of his way to hide this glaring detail.

SMEV consulting team urges the company to “1. Move accounting away from PeachTree”

Less than five years after defrauding Simulated Concepts, Eric Noveshen becomes President of Microvu in December 2014. Guess who he brings to work on the financials? Mother Dear? Bingo! Cheryl Wilson starts working undercover to doctor financials for the benefit of herself and her son. The pair even pretended they did not know each other in the office.

From Multaply v. Kern, filed in November 2015

People might say ah, what about Ajene Watson? Here is the difference, Watson, for any faults one might perceive, is not a selfish or slovenly businessman like Noveshen. He leaves his house in a suit and tie, looks sharp, speaks well. Watson gives back to the community. Watson’s mother didn’t teach him how to cook books. Trywa Watson taught children and was a highly respected educator in New York. While Noveshen works to destroy his mother’s name in court records (all those phony affidavits of Cheryl Wilson against Amex, Nationstar etc all looked at together don’t seem credible). While Watson honors his late mother’s name. In 2010 Ajene Watson donated thousands of dollars to the school where his mother taught, Middle School 390, to open The Trywa Watson Computer Lab. Watson claimed his mother taught him a code of ethics and morals. Something you won’t find in his business partner’s history.

Eric Noveshen Seeks to Conceal his Fraudulent Business Activities

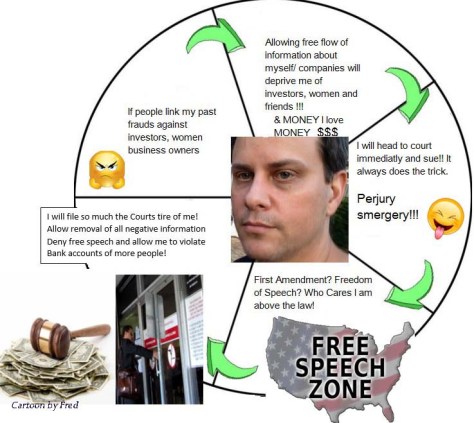

Eric Noveshen, a great divisor of financial schemes, a great vexatious litigant, a great manipulator of Florida foreclosure laws to attain free housing, a great, to sum it up a great fraud – is seeking to have this website and any others exposing his financial scams taken down.

Noveshen demands that these pages contain “untruthful” claims and defamatory remarks, much like the baseless “Cease and Desist” Noveshen posted on a RipOff Report about his business. Other then reader comments, which we cannot verify, Noveshen has not identified anything untruthful on this site. The fact is every blog is based on and often features the public document upon which it is based. Proof is in the publications, many written by Noveshen himself.

Noveshen’s goal is to deprive would be investors of information. He will bully, harass, stalk and sue, anyone attempting to combat his economic crimes through exposure. He want’s this site down because it links his dozens of fraudulent activities in one easy-to-find location, ultimately shrinking his pool of potential victims to deprive of money. Operating in secrecy is the only way the “stinky pinky” penny stocks Noveshen makes a living off of thrive. If his name is publicly linked investors would run!

We issue this challenge – can someone provide the name of ONE company Eric Noveshen has been a broker/employee where he was not sued for illegal broker activities? Or fired for same? Or didn’t include in his personal bankruptcy to avoid repayment of debt? Not Roan Meyers (sued and settled for unauthorized trading, fraud, common law fraud and negligence). Not Gruntal & Co. (sued unauthorized trades) ultimately fired for violation of firm policy. Not Newbridge Securities, see Noveshen bankruptcy filing, 2005.

Is there any company Eric Noveshen has acted as a “consultant” to that is not associated with claims of kickbacks, shorting, churning, pump and dump or other stock manipulation tactics?

Is there any home Eric Noveshen has resided from 2000-2016 that has not been the subject of a foreclosure lawsuit? See Bank One Indymac v. Eric L. Noveshen 2003. Wells Fargo v. Christina Noveshen and Eric Noveshen 2003. Or property documents on 436 NE 10th Ave, 33301 and 508 Coconut Isle Dr., 33301.

Cooking the Books, Eric Noveshen Family Recipe

As seen in past posts, Eric Noveshen, and his alter ego Envision Capital are very sensitive to any negative posts about himself, calling them slander and defamatory no matter how true they might be.

Source: InvestorsHub.com

Source: InvestorsHub.com

Yet under the guise of litigation privledge Noveshen freely makes up false defamatory statements about many others. Though he was a contracted “consultant” of a Florida company called Spa Capsule, which partially under his direction turned out to be a penny stock pump-and-dump, Noveshen actively promoted his counter- lawsuit and its false accusations about the company owner Allen Licht (ticker SMEV). He spread the word to so many that the allegations ended up in posts on stock promo boards, such as Investors Hub. Wouldn’t accusing someone of money laundering be just as slanderous as saying someone took kickbacks and shorted stocks?

http://investorshub.advfn.com/Simulated-Environment-Concepts-Inc-SMEV-9628/

Source: Investorshub.com

Source: Investorshub.com

Ironically the exhibits refered to have Noveshen’s Mother Cheryl Wilson’s hand writing all over them. According to Allen Licht, Novehen “inserted his Mother” as the bookkeeper. Questionable? You bet ya. Cooking the books? Or more professionally stated, falsification of financial documents? You be the judge. One of the so called documents is below. Pay attention to the Cher in Cheryl, the Cher above Dr. Frank Donaruma, the y at the end of Happy and the y in Cheryl. Nice hand writing though if its used for good cause.

UPDATE (Feb 18, 2016): RESPONSE TO COMMENT ASKING FOR PHOTOGRAPH TO IDENTIFY ERIC NOVESHEN’S MOTHER SINCE HE ATTEMPTS TO MASK THEIR RELATIONS:

Was Noveshen Planning to Pump-n-Dump Multaply INC. Before Company Caught his Scamming Ways?

The federal lawsuit filed in November 2015 by Multaply INC of Fort Lauderdale, FL, against many including former employees Eric Noveshen and Timothy Wagner, makes one wonder:

Was Eric Noveshen planning to take MULTAPLY public and pump-n-dump it like his other stocks, EDWY, SMEV, HIMR, PNOW, ECMH……? Is that why they are suing him?

Eric Noveshen was listed as an officer of the company and had a hand in registering Multaply in Nevada (Nevada laws do NOT require companies to make their shareholder lists public making it easier for pump-and-dump operators to stay behind the scenes unknown to potential investors/victims.)

Multaply might have been his next pump-n-dump. Thank your lucky stars penny investors- one less penny predator to fear.